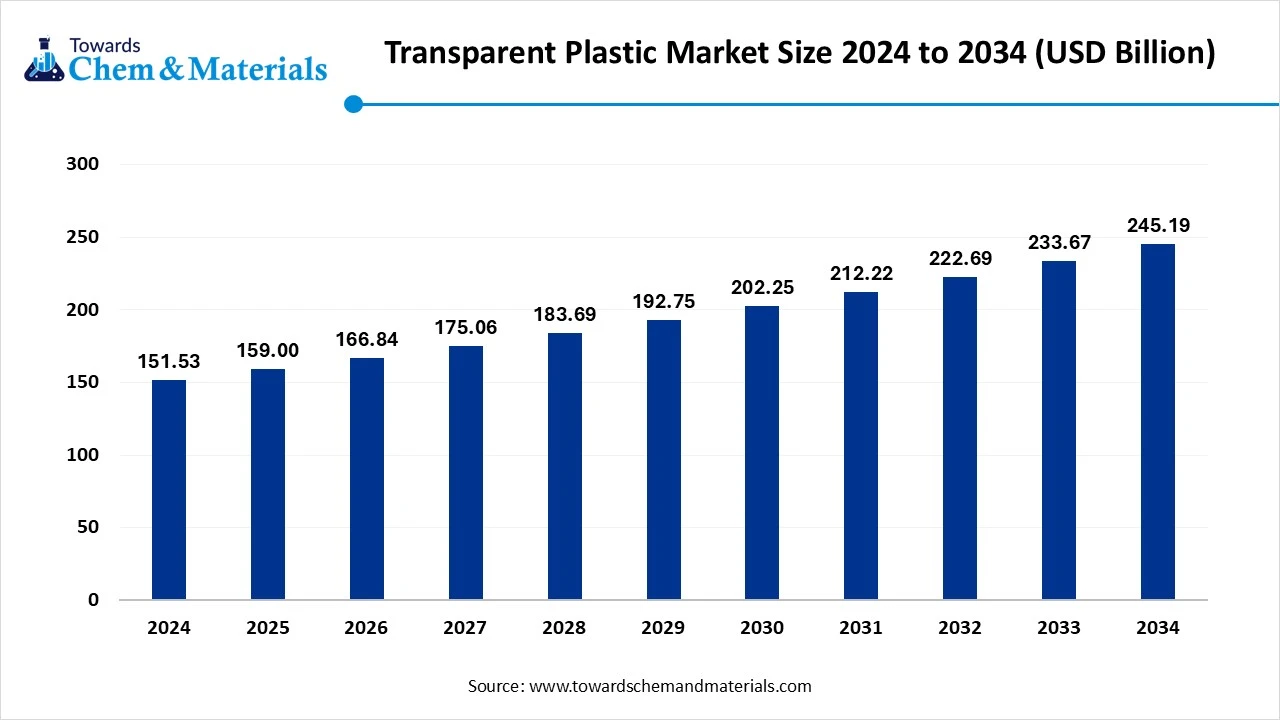

Transparent Plastics Market Size to Worth USD 245.19 Billion by 2034

According to Towards Chemical and Materials, the global transparent plastics market size was estimated at USD 151.53 billion in 2024 and is expected to be worth around USD 245.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.93% over the forecast period from 2025 to 2034.

Ottawa, Aug. 28, 2025 (GLOBE NEWSWIRE) -- The global transparent plastics market size is estimated at USD 159.00 billion in 2025 and is projected to reach USD 245.19 billion by 2034, growing at a CAGR of 4.93% from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The market is expanding steadily, as demand for it increases in packaging, automotive and electronics, as well as innovations in lightweight, durable and recyclable material solutions support overall growth.

Download a Sample Report Here @ https://www.towardschemandmaterials.com/download-sample/5767

Transparent Plastics Market Overview

The transparent plastics market refers to polymers that transmit light at nearly the same rate as glass, but are lighter, stronger, more flexible, and more resistant to chemicals. This applies to polycarbonate, acrylic, and polystyrene and has a multitude of applications within the automotive, packaging, consumer goods, construction, and medical sectors.

The primary drivers for this market are an increasing demand for lightweight components for automotive and aerospace, an increasing adoption of transparent materials for the packaging of food and beverage goods, and an expanding application of transparent plastics in electronics and healthcare.

Transparent Plastics Market Highlights

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held a 45% share in the market in 2024. The rapid industrialization and urbanization fuel the growth.

- By polymer type, the polycarbonate (PC) segment dominated the market in 2024. The polycarbonate (PC) segment held a 30% share in the market in 2024. It is used in the automotive industry due to its durability, which fuels the growth.

- By form, the rigid transparent plastics segment dominated the market in 2024. The rigid transparent plastics segment held a 65% share in the market in 2024. The high strength and stability drive the growth of the market.

- By manufacturing process, the injection molding segment dominated the market in 2024. The injection molding segment held a 40% share in the market in 2024. Extensive use in medical devices supports the growth.

- By application, the packaging segment dominated the market in 2024. The packaging segment held a 35% share in the market in 2024. High clarity, impact resistance, and barrier properties influence the growth.

- By distribution channel, the direct sales to the OEMs segment dominated the market in 2024. The direct sales to the OEMs segment held a 55% share in the market in 2024. The supply and quality of application fuels the growth.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5767

Transparent Plastics Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 159.00 billion |

| Revenue forecast in 2034 | USD 245.19 billion |

| Growth rate | CAGR of 5.95% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Volume & revenue forecast, competitive landscape, growth factors, and trends |

| Segmentation covered | By Polymer Type, By Form, By Manufacturing Process, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE |

| Key companies profiled | Dow, Inc.; SABIC; BASF SE; Covestro AG; PPG Industries, Inc.; LyondellBasell Industries N.V.; DuPont de Nemours, Inc.; INEOS Group Limited; LANXESS AG; Berry Global; Cosmo Films; Amcor plc |

What are the Major Trends in the Transparent Plastics Market?

- Increase in demand in automotive & aerospace- Lightweight transparent plastics are being used more often instead of glass, in both vehicles and aviation. Some applications include windows, lighting systems, and other parts of the interior to improve fuel efficiency, safety and make it flexible in design.

- Moving towards sustainable alternatives- As regulations are appearing stricter, producers will invest in recyclable and bio-based transparent plastics to help diminish some of the apprehension regarding plastic waste, and to better meet the requests of consumers for environmentally friendly packaging and long-lasting alternatives.

- Rising demand in healthcare- Transparent plastics are being used more in the development and manufacturing of medical devices, surgical instruments, and packaging. Here, transparent plastics are favoured for their clarity, strength and even sterilization, as well as their safety, which has led to a consistent source of demand in the healthcare and pharmaceutical sectors.

- Growth in the consumer electronics- The electronics market also has the potential to use clear plastics for products like displays casings and optical parts. In this case, transparent plastics offer a lightweight, impact resistant, design flexible alternative that gives producers an improved response to ever-increasing consumer demand for thin, light and tough products.

Growth Factor in the Transparent Plastics Market

Are Lightweight and Durable Material Growth Driving the Demand for Transparent Plastics?

A key factor driving the transparent plastics market is the desire for lightweight, durable, and versatile materials across many sectors. Automotive companies are using lighter, more durable, and flexible transparent plastics instead of conventional glass in headlamps, windows, and other exterior as well as interior parts of vehicles, which is increasing fuel efficiency and lightening overall vehicle weight. The healthcare sector is experiencing a similar increase in adoption of transparent plastics in medical devices, packaging, and diagnostic equipment, because transparent plastics are clear, safe, and compatible with sterilization procedures.

New developments in polycarbonate plastic and acrylic-based transparent plastics are re-sales allow advancements in impact resistance and design flexibility. In 2024, several packaging companies launched sustainable transparent plastics specifically for food and beverage applications that included both safety and visibility. In 2025, Oroville Flexible Packaging, LLC, launched “Oroflex,” sustainable flexible plastics, packaging and recycling system. This shift to functionality, sustainability, and flexibility explains why transparent plastics are growing a preference to conventional materials.

How Is AI At The Forefront Of The Future Of Transparent Plastics?

As a core enabler in the transparent plastics market, artificial intelligence is improving product quality, accelerating innovation, and facilitating recyclability. In February 2025, Argonne’s uses Polycot, an AI automated material laboratory to develop a low-defect electronic polymer film design for transparent coatings.

The integration of AI-powered computer vision for detecting defects in PET bottles and clear sheets for instant detection of scratches, bubbles or sealing errors that reduce rejections and improve compliance with industry standards and regulations. In sorting PET and PMMA, AI-based platforms such as TOMRA Insight and Polymercaptan can increase sorting accuracy and source high-purity recycled materials to meet Europe’s higher Packaging and Packaging Waste Regulation (PPWR) standards.

Will The Expansion of Applications in Electronics and Smart Devices Support Growth Opportunities for Transparent Plastics?

The growing applications in electronics and smart devices are another exciting opportunity for the transparent plastics market. The use of transparent plastic product is taking off in electronics due to the combination of durability, optical clarity, and lightweight composition. Products like polycarbonate and acrylic are being accepted in displays, touch screens, LED light covers, etc. In addition, many devices now also contain ergonomic or flexible displays, thanks to the growing popularity of smart devices and the development of flexible/foldable display technologies will also continue to increase demand for advanced transparent materials.

In 2024, several tech companies displayed transparent plastic products in their development of next-generation AR/VR headsets and other smart gadgets, which broadened their design options and improved overall user experience. Thus, the expanded application of transparent plastic offers considerable growth opportunities globally for both market segments.

Limitations and Challenges in the Transparent Plastics Market

- Elevated production costs- Clear plastics like acrylic and polycarbonate commonly require specialty additives and complex processing to achieve clarity and durability, increasing overall production costs and making them less competitive to traditional plastics in applications where cost is a factor.

- Environmental issues- Generally transparent plastics are largely petroleum-based, non-biodegradable and do cause plastic pollution. There is increasing social and regulatory pressure for sustainability increasing restrictions on single-use plastics are restricting their broader application, particularly related to packaging and consumer-facing products.

- Raw material input price volatility- As a market reliant on petrochemical-derived industrial feedstock; transparent plastics and their market prices depend on crude oil prices. Their volatility not only affects production costs but also uncertainty for manufacturers and end users.

- Competition from alternatives- Clear plastics are increasingly being replaced by glass, bio-based polymers, etc., and competing with environmentally friendly substitutes in automotive, construction and packaging. Increased preference for sustainable substitutes could reduce demand in multiple industries for the long-term.

Why Is Asia Pacific The Dominant Player In The Transparent Plastics Market?

Asia Pacific dominated the market in 2024. Asia Pacific leads by virtue of size alone on both the supply side and demand side. China led the charge on capacity additions in PET and more broadly in polyolefins/PVC with effective resin supply locally, which lowers conversion costs on packaging, medical disposables, and electronics glazing, creating competitive advantage. Also, intense adoption of EVs is also rapidly increasing use of polycarbonate lenses and PMMA light guides, and ongoing regional push for circularity is catalysing rPET investment. The net result is that APAC remains one of the centerpieces of global production and is also absorbing vast downstream demand.

China Market Trends

The auto and EV boom in China is directly pulling demand for transparent plastics for lighting, glazing, HUD covers, and interiors. The China Association of Automobile Manufacturers (CAAM) has forecast that total auto sales will reach 32.9 million units in 2025, marking a year-on-year increase of 4.7%. At the same time, China is adding large PET capacities in 2024–2025, while also scaling up food-grade rPET, thus tightening the loop for beverage and healthcare packaging. This combination of demand depth and upstream capacity allows China to remain a key bellwether for APAC converters and OEMs.

Why North America showing up as the Fastest Growing Region in Transparent plastics?

North America expects the fastest growth in the market during the forecast period. North America is finding itself to be the fastest growing region for transparent plastics because of favorable policies and a rapidly adapting industry. Sustainability regulations are pushing packaging producers and converters to utilize more recyclable and recycled-content materials. Transparent plastic is needed in food/beverage applications along with the healthcare applications where it assures safety and compliance with food labeling and hygiene standards. North America also has a growing recycling ecosystem that is regularly improving availability of consistent quality recycled plastic resins, which leads to greater adoption of recycled plastics in packaging and consumer goods.

Market Trends in U.S.

The U.S. is leading the growth for the region resulting from legislation and corporate commitments converging. State level recycling and packaging laws are requiring companies to redesign their products to achieve more reusability and more transparent recyclable plastics. The private sector is led by consumer brands investing in rPET options or bio-based alternatives for new impact on jobs and local economies across packaging, automotive, and medical sectors. The combination of regulations, corporate driven sustainability initiatives and improving recycling infrastructure is why the U.S. will remain the catalyst propelling North America's rapid adoption of more transparent plastics.

Transparent Plastics Market Segmentation

Polymer Type Insights

What Polymers Type is the Most Dominant in Transparent plastics?

The polycarbonate (PC) segment dominated the market in 2024, due to its remarkable strength, longevity, and optical clarity. PC is commonly utilized for automotive glazing, electronic housings, and construction panels. It has strength without compromising transparency. PC's versatility under severe operating conditions and increasing adoption into safety-related products, has also ensured that it remains the preferred transparent polymer on the market.

The polymethyl methacrylate (PMMA) segment will continue to grow at fastest CAGR during the forecasted period, fueled by high strength-to-weight ratio, scratch resistance, and excellent weatherability. Increasing use in automotive lighting, signage, and consumer electronics continue to drive the growing PMMA demand. PMMA also has shaped how designers with sustainable designs or contemporary architectural applications incorporate visual appeal with lasting clarity which explains the segment's continued growth.

Form Insights

Which Form is More Prevalent in the Transparent Plastics Market?

The rigid transparent plastics segment dominated the transparent plastics market, from widespread applications in packaging, construction, and consumer products. Rigid transparent plastics are the materials of choice for making bottles, containers, and for industrial applications because of its strength, shape durability, and resistance to wear. In almost all segments, at points where quality, durability, and structural integrity are required, rigid forms are the material of choice.

The flexible transparent plastics segment is experiencing fastest growth in foreseeable period, from increasing demand in flexible displays, films, and wearables. The flexibility of transparent flexible plastics, low weight, and ease of processing has made this form of plastic desirable to next-generation electronics, medical, and protective films. Consumer preference for more portable and foldable products is supporting this trend.

Manufacturing Process Insights

Which Manufacturing Process is the Most Prominent in the Transparent Plastics Market?

The injection molding segment had the largest share of the transparent plastics market in 2024, by a considerable distances other processes because injection molding is typically higher-volume production, and because of that volume injection molding produces more accurate and efficient parts than other manufacturing methods. Furthermore, injection molding can create complex components that are needed in automotive technologies, patient healthcare devices, packaging, and electronics technologies. The economic nature of the process making complex designs is also reduction on materials used.

The thermoforming segment is emerging fast as fastest growing process in projected period, with its economic aspects of producing unique customized packaging. It is gaining traction in the food, pharmaceuticals, and consumer goods space to produce lightweight yet sturdy transparent containers, trays and others. The shift towards recyclable sustainable packaging will continue to influence this space positively.

Application Insights

Which Application is the Dominate the Transparent Plastics Market?

The packaging segment accounted for the largest share of the market, as packaging is widely used in food and beverage, pharmaceuticals, and consumer goods, among others. Transparent plastics allow products to be seen, thus increasing shelf life and also providing additional protection to the product while in storage or while shipping. Additionally, the lightweight and design flexibility of transparent plastics allows manufacturers to provide functional packaging, while also making it visually attractive to the consumer.

The automotive & transportation segment is experiencing fastest growth, presenting manufacturers with a greater demand for lighter weight materials, durability and visually clear materials in components used in making vehicles. Currently, uses for transparent plastics are moving increasingly toward lighting systems, windows, and interior applications. As the industry trend moves increasingly toward electric and autonomous vehicles, demand for innovative, energy-efficient and visually, and aesthetically sound materials is growing.

End-Use Industry Insights

Which End-use Industry Holding a Large Share in the Transparent Plastics Market?

The healthcare industry accounts for a large market share of transparent plastics market in 2024, because transparent plastics are used in medical devices, surgical instruments, medicine packaging and a myriad of diagnostic equipment. Their clarity, chemically resistance to various medications, and their sterilization ability are key features that allow them to be used in clinical settings. Current demand for disposable devices as well as advanced medical operations helps support their overall importance in the healthcare industry.

The packaging industry is the end-use industry growing at fastest CAGR, because of increasing demand in food, beverages, and e-commerce markets. Transparent plastics provide product visibility, shelf-life extension, and safe transportation. We also see manufacturers moving to packaging sustainable and recyclable as well as lightweight packaging as sustainability concerns grow. This is leading to the rapid adoption of transparent plastics in more modern packaging applications.

Distribution Channel Insights

Why Direct Sales Segment Dominates the Transparent Plastics Market in 2024?

The direct sales to the OEMs (original equipment manufacturers) segment is the dominant distribution channel in transparent plastics market in 2024, This is efficient, technical service is better, can allow for customized modifications, and it lower the cost of suppliers when going to direct to the OEM. Partnerships in OEMs are strong in automotive, healthcare, and packaging industries, among others, where these sectors gravitate heavily toward product reliability and high-performance weight bearing.

The online industrial platforms segment is expected to register the highest growth rate in forecasted period, on account of the digital procurement and supply chain channel being adopted by buyers. Various buyers prefer using these online industrial platforms due to their convenience, added transparency of pricing, and a wider catalogue of products. eCommerce for industrial materials is on the rise, and the utilization of e-procurement for digital buying needs are growing. As a result, these factors all contribute toward faster growth in online distribution.

More Insights in Towards Chemical and Materials:

- U.S. Transparent Plastics Market : The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

- Asia Pacific Bioplastics Market : The Asia Pacific bioplastics market volume was reached at 2.51 million tons in 2024 and is expected to be worth around 11.13 million tons by 2034, growing at a compound annual growth rate (CAGR) of 16.07% over the forecast period 2025 to 2034.

- Europe Bioplastics Market : The Europe bioplastics market volume was reached at 7.45 million tons in 2024 and is expected to be worth around 40.16 million tons by 2034, growing at a compound annual growth rate (CAGR) of 18.35% over the forecast period 2025 to 2034.

- Bioplastics Market : The global bioplastics market volume was reached at 11,40,000.0 tons in 2024 and is expected to be worth around 73,21,706.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 20.44% over the forecast period 2025 to 2034.

- Engineering Plastics Market : The global engineering plastics market size was reached at USD 146.95 billion in 2024 and is expected to be worth around USD 312.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.85% over the forecast period 2025 to 2034.

- Europe Plastics Market : The Europe plastics market volume was reached at 55.10 million tons in 2024 and is expected to be worth around 64.32 million tons by 2034, growing at a compound annual growth rate (CAGR) of 1.56% over the forecast period 2025 to 2034.

- Recycled Thermoplastics Market : The global recycled thermoplastics market size was estimated at USD 57.85 billion in 2024 and is expected to hit around USD 145.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period from 2025 to 2034.

- High Performance Plastics Market ; The global high performance plastics market size was valued at USD 26.85 billion in 2024 and is estimated to reach around USD 65.57 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 9.34% during the forecast period 2025 to 2034.

- Transparent Ceramics Market : The global transparent ceramics market size was reached at USD 619.40 million in 2024 and is expected to be worth around USD 2,409.47 million by 2034, growing at a compound annual growth rate (CAGR) of 14.55% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was reached at USD 410.73 billion in 2024 and is expected to be worth around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034.

- Circular Plastics Market : The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034.

Transparent Plastics Market Top Key Companies:

- Dow, Inc.

- SABIC

- BASF SE

- Covestro AG

- PPG Industries, Inc.

- LyondellBasell Industries N.V.

- DuPont de Nemours, Inc.

- INEOS Group Limited

- LANXESS AG

- Berry Global

- Cosmo Films

- Amcor plc

Recent Developments

- In May 2024, Dow and SCG Chemicals (SCGC) signed a memorandum of understanding (MOU) to create a circularity partnership in the Asia Pacific region aimed at transforming 200,000 tons per annum (KTA) of plastic waste into circular products by 2030. The agreement focused on advancing technologies for both mechanical and advanced recycling to convert a broader range of plastic waste into high-value applications.

- In March 2025, the Philippines launched the National Plastic Action Partnership (NPAP), to tackle its growing plastic waste crisis and promote a circular economy. Led by the Department of Environment and Natural Resources (DENR), NPAP united the government, private sector, civil society, academia, and development partners to develop inclusive, collaborative solutions to reduce the country's annual 2.7 million metric tons of plastic waste, a significant portion of which pollutes oceans.

Transparent Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Transparent Plastics Market

By Polymer Type

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Transparent Polypropylene (PP)

- Others (COP/COC, TPU, etc.)

By Form

- Rigid Transparent Plastics

- Flexible Transparent Plastics

By Manufacturing Process

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Casting

By Application

- Packaging (food, beverage, cosmetics, pharmaceuticals)

- Building & Construction (windows, skylights, panels)

- Automotive & Transportation (windshields, lighting, interiors)

- Electrical & Electronics (screens, covers, lenses)

- Medical & Healthcare (syringes, diagnostic devices)

- Consumer Goods (furniture, eyewear, sports equipment)

By End-Use Industry

- Packaging

- Construction

- Automotive

- Electrical & Electronics

- Healthcare

- Consumer Products

By Distribution Channel

- Direct Sales to OEMs

- Plastic Resin Distributors

- Online Industrial Platforms

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5767

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.